What the Hell Is a Reciprocal Tariff? A No-BS Explainer

Tired of economic policy written by and for the people who benefit most from economic inequality? Same. Let’s break down what a reciprocal tariff actually is—without the corporate apologia, Wall Street spin, or sanitized language meant to keep working people out of the conversation.

If you need to know where this starts, it starts here:

Executive Summary of Reciprocal Tariff Calculations

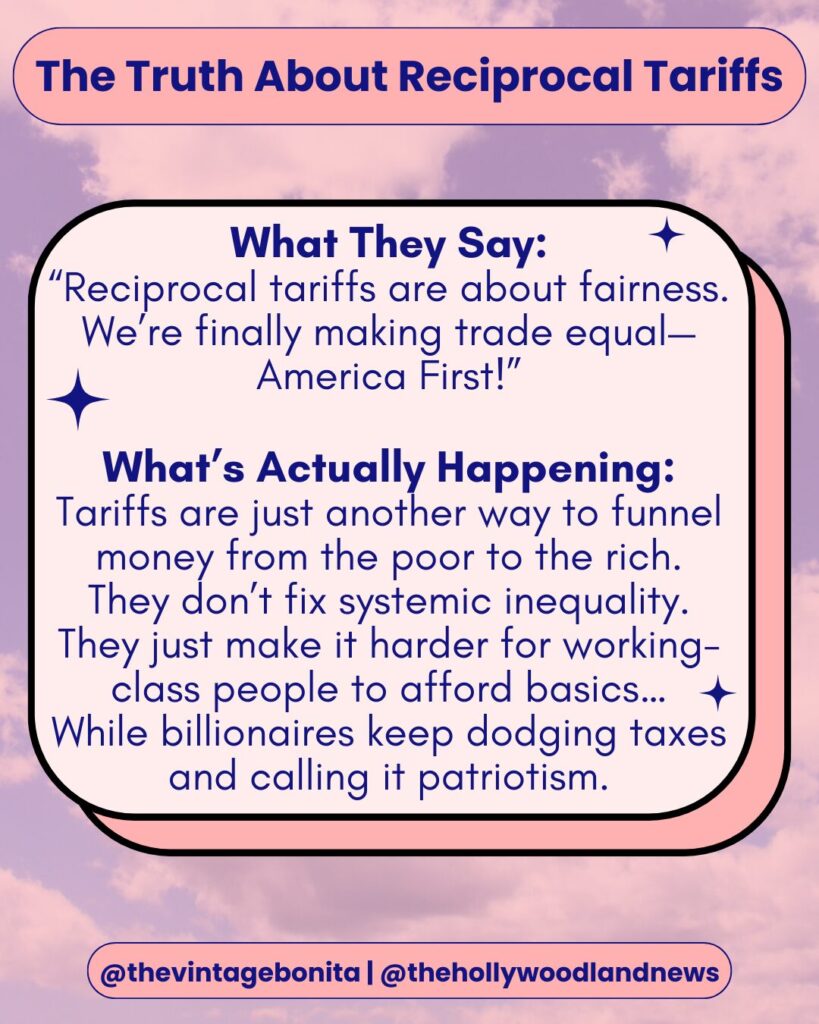

If you’re more of give it to me quick visual learner, I gotchu:

Cupcakes, But Make It Capitalist Exploitation

If you felt like reading all of that was too much, I am going to break it down with a mathologist and what I know to be facts and science.

Picture this: every week, you bring cupcakes to a potluck. You buy the ingredients, bake them, and clean up afterward. Meanwhile, another kid—let’s call them China—never brings anything. They just show up, take three cupcakes, and bounce.

Eventually, you’ve had enough. You say, “You want a cupcake? Cool—pay up.”

That’s the idea behind reciprocal tariffs. The U.S. is buying way more from some countries than they’re buying from us. So we slap a tariff—a tax—on their goods to try and even things out.

Sounds fair if you say it fast. But here’s the truth: it’s capitalist sleight of hand disguised as justice. It’s not about creating equity—it’s about controlling markets and reinforcing systems where working-class people pay the price for elite failures.

Reciprocal Tariff Explained: Who Really Pays for It?

Spoiler alert: We do.

Not the billionaires. Not the lobbyists. Not the ones who actually benefit from global trade imbalances. When I spoke with an economist, who preferred to stay anonymous for risk of losing their job, they said,

“You don’t fix a broken economy by taxing a t-shirt. You fix it by taxing billionaires, breaking up monopolies, and investing in the people who’ve been holding this country together with underpaid labor and hope.”

These tariffs don’t touch the CEOs of multinational corporations who offshore labor and dodge taxes. They hit us—the working class, the poor, the folks already rationing insulin, stretching food stamps, or skipping dental visits to keep the lights on.

So when politicians wrap this in an “America First” flag and call it justice, what they’re really saying is:

“Let’s make basic goods more expensive so you’re forced to buy from companies we refuse to regulate.”

This isn’t about fairness. It’s about control. It’s about forcing you to buy overpriced American-made products from the same corporations that spent the last four decades breaking unions, laying off workers, and automating every job they could.

My source says exclusively to Hollywoodland News:

“Reciprocal tariffs aren’t about fairness. They’re about redirecting public anger away from the corporations that offshored our jobs—and toward the countries that filled the vacuum. If we wanted real fairness, we’d tax the rich, fund public industry, and stop making poor people pay for capitalist failures.”

If you can’t afford those new higher prices? That’s your problem. Not theirs.

This isn’t economic justice. It’s economic punishment—and the people handing out the fines are the same ones who created the crisis.

Why Reciprocal Tariffs Exist—And Why That’s Bullshit

Because we’ve had a trade deficit for 50+ years. We import more than we export. But instead of investing in people, communities, and actual industry, the U.S. chose the path of least resistance—and highest profit—for the already wealthy.

Here’s a list of the perpetrators:

- Deregulated everything to please Wall Street

- Let corporations ship jobs overseas and called it “innovation”

- Underfunded workers in the name of “efficiency”

- Dismantled public education to keep us underpaid and underprepared

- Let other countries pass us in tech, clean energy, and social infrastructure

- Crushed unions while handing bailouts to the same companies that gutted small-town America

Meanwhile, countries like Germany and South Korea actually support their labor force: universal health care, free or affordable education, worker training, childcare, housing. They invest in the people doing the work.

We did the opposite—and now we’re slapping tariffs on imports like that’ll fix the mess.

Reciprocal tariffs are a weak-ass bandage on the open wound of capitalism.

They won’t rebuild what’s been lost. They won’t revive domestic manufacturing without radical change. And they definitely won’t save us from a system that was never designed to serve working-class people, immigrants, or communities of color in the first place.

Because we’ve had a trade deficit for 50+ years. We import more than we export. And instead of building systems that empower domestic labor and fair production, we:

- Deregulated everything

- Let corporations outsource everything

- And underfunded U.S. workers in the name of “global competitiveness”

Reciprocal tariffs are a desperate attempt to fix decades of corporate greed without actually holding corporations accountable, immigrants, or communities of color in the first place.

That Equation They Dropped Like a Truth Bomb

Yeah, this one:

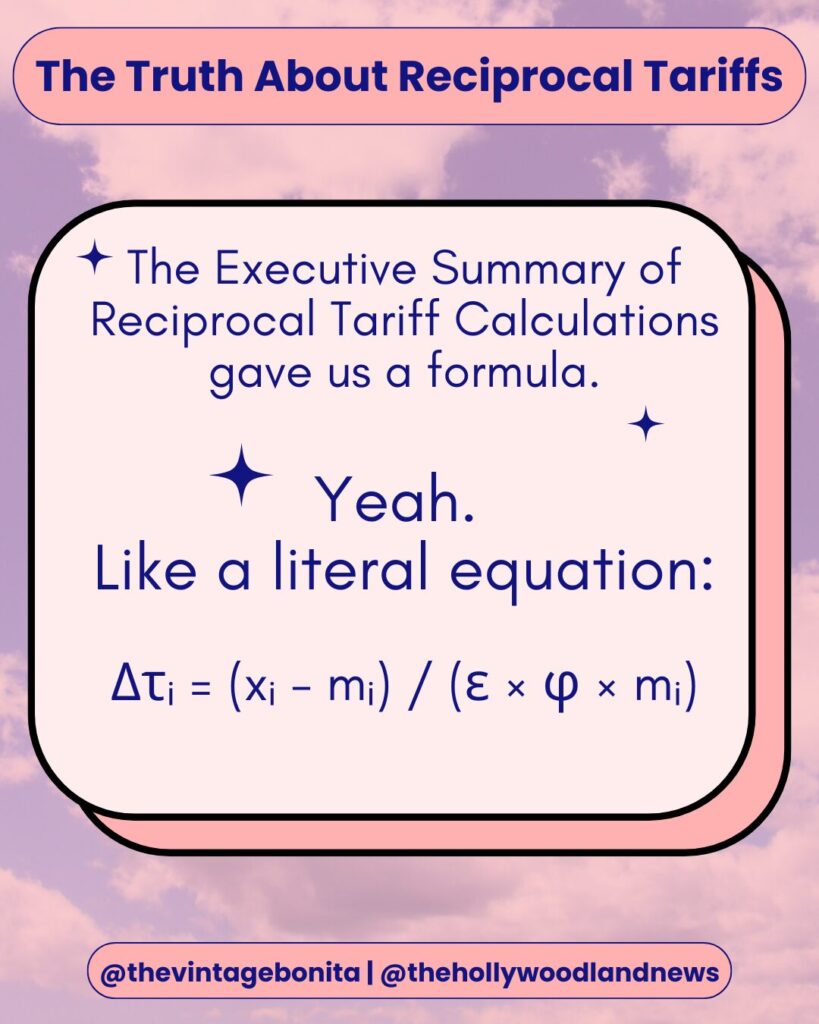

Δτᵢ = (xᵢ – mᵢ) / (ε × φ × mᵢ)

If that made your eyes glaze over, you’re not alone. So I asked an economics person, who chooses to stay anonymous because they don’t want to lose their job. I asked them to help me (who failed advanced algebra twice) and here’s what they’re trying to say in easy non-mathy words:

“We figured out a number that, if we tax imports at that rate, we’ll stop buying more from them than they buy from us.”

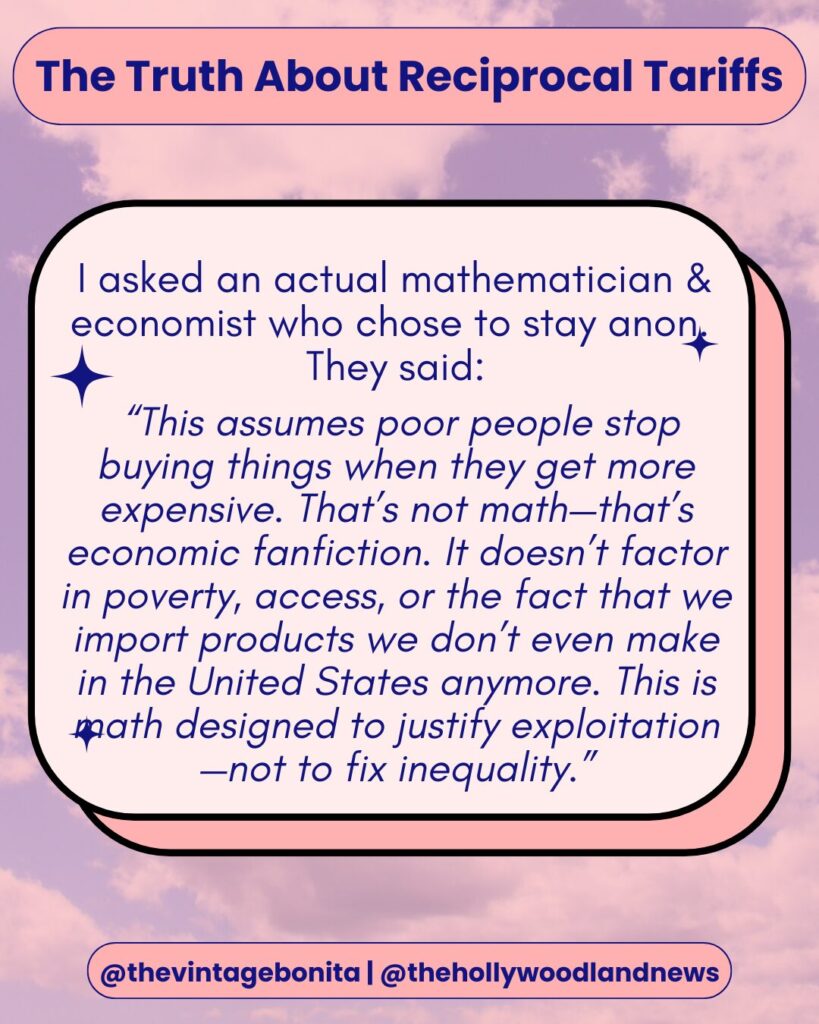

It sounds logical—on paper. But my anonymous mathematician source breaks down why this is smoke and mirrors for anyone who lives in the real world:

- xᵢ is what they buy from us (exports)

- mᵢ is what we buy from them (imports)

- ε (elasticity) means how much we’ll cut back on buying if prices rise

- φ (passthrough) is how much of the tariff actually shows up in the final price

So this whole thing calculates a number that’s supposed to magically make trade “even.” It’s based on the idea that if we raise the price of imports, Americans will buy less of them—and that somehow this will force other countries to buy more American stuff.

But here’s the thing: according to my source, this is just a math fantasy.

- It doesn’t consider that we import essentials like food, medicine, and tech we don’t even make here anymore

- It assumes people have choices. They don’t. If eggs cost more, you still buy eggs.

- It assumes other countries want to buy what we’re selling—and that we even have the manufacturing infrastructure to supply it

- It assumes everyone behaves like an economist’s spreadsheet, not like a broke parent trying to stretch one paycheck across three weeks

This equation is academic cosplay. It looks smart and authoritative, but it’s completely detached from the lives of real working-class people. It’s the kind of thing you invent when you want a policy to feel legitimate without actually making it just.

My source told me, as plain as they could, because math is the opposite of my strong suit:

“The reciprocal tariff equation is mathematically sound, but practically fragile. It assumes consumer behavior follows clean, predictable lines and ignores structural issues like supply chain dependency, labor policy, and income inequality. In the real economy, equations don’t operate in a vacuum.”

They act like it’s science. It’s not. It’s a math trick based on guesswork.

- It assumes consumers will behave predictably (lol)

- It ignores inflation, wage gaps, and systemic inequity

- It doesn’t factor in that the U.S. exports weapons and imports literal necessities

You can’t plug inequality into a spreadsheet and expect justice to come out the other side. Do you really think the dudes who don’t believe global warming is an actual science thing are going to give you math and science to explain their rationale? Slow down there, Chester Cheetah, your orange is showing.

🔥 So What Would Actually Help?

You want to fix trade? Cool. Then let’s:

- Tax the billionaires who’ve profited from wage theft and outsourcing

- Rebuild the labor movement—not just lip service, but real power

- End corporate welfare for companies that offshore jobs and dodge taxes

- Invest in public infrastructure, green energy, and community-owned manufacturing

- Legalize and protect immigrant workers—because you can’t rebuild American labor without the people who’ve been doing it under the table for decades

Reciprocal tariffs won’t do that. They’re a distraction—a nationalist prop pretending to be economic justice. But don’t just take my word for it, like who the fuck am I, anyway?

Taking that into consideration, I asked my source about what they believe would fix trade instead of reciprocal tariffs?

- “If policymakers want to reduce trade deficits without hurting consumers, they need to stop relying on oversimplified economic models and start investing in structural solutions:

- Strengthen domestic manufacturing through targeted investment and innovation grants

- Fund education and workforce training to close the skills gap

- Rebuild public infrastructure to reduce logistical costs

- Reform tax policy to support small and mid-sized producers over monopolies

TL;DR: The Real Deal on Reciprocal Tariffs

Don’t have time (or the patience) to read the whole policy doc?

Here’s what you need to know, no PhD or mathology required:

| What the USTR Says | What It Really Means |

| Trade deficits are caused by other countries’ tariffs and policies. | Trade deficits exist because American corporations chased profits and politicians let them hollow out local economies. |

| We can balance trade by charging other countries more to sell here. | This is a tax on the stuff you buy—meant to pressure countries without fixing what’s broken at home. |

| The math tells us exactly what the tariff should be. | The math is based on elite economic theory, not real life—working people will feel the price hikes, not the CEOs. |

| Tariff rates could be as high as 99%. | That $15 phone case? Get ready to pay $30. And no, the rich won’t feel a thing. |

| This helps protect American industry. | It protects corporate profits, not people. Without labor protections, it’s just nationalism wrapped in a spreadsheet. |

- It’s a tax on imports that sounds fair but screws the poor

- It won’t rebuild American industry—it’ll just make essentials more expensive

- It’s not a labor policy, it’s a corporate tactic

- And if we don’t fix the system, this is just another way to make capitalism look patriotic

Let the billionaires fight over market share. We’re fighting for survival.

Leave a Reply